This Investment Strategy Will Change You Forever - And Anyone Can Do It [Nassim Taleb, Tim Ferriss]

Hey friend!

I have collected some nuggets on a very special Investment Strategy (which we will see that is based on a mathematical property which extends from Investing into any life domain) that it is far from being the common strategy in the world of Investing and the Finance Industry. This strategy is coined as “The Barbell Approach”, and consists in being extremely conservative for the most part (80-90%), and for the other 10-20% be extremely aggressive (extreme high risk-reward opportunities) — that’s why is called the Barbell, because everything is on the extremes, nothing in the middle. This approach is how Nassim Taleb thinks about asset allocation in Investing, and investor Tim Ferriss is a big follower of it.

Along the notes, we will see why exactly this performs better than the traditional investment portfolios (e.g./ 60% stocks & 40% bonds…).

I hope you will find this blogpost valuable :)

🧠 Quotes

"I subscribe to the Nassim Taleb school of investment, with 90% in conservative asset classes like AAA bonds and the remaining 10% in speculative investments that can capitalize on positive 'black swans' "

- Tim Ferriss

"It's much better to put 80% of your money risk-free, and 20% speculative. Rather than the whole thing medium risk. Much more robust that way."

- Nassim Taleb

"Just as Stoicism is the domestication, not the elimination, of

emotions, so is the barbell a domestication, not the elimination, of

uncertainty."- Nassim Taleb

"Make sure that the probability of the unacceptable (i.e., the risk of ruin) is nil.”

- Ray Dalio

👨 Giants

Nassim Taleb

Nassim Taleb's work concerns problems of randomness, probability, and uncertainty. Author of many successful books, including The Black Swan, which The Sunday Times considers one of the 12 most influential books since World War II.

Tim Ferriss

Tim is an entrepreneur. He runs the Tim Ferris Podcast, which has over 1 million subscribers. Author of many popular books, including Amazon's best seller book "The 4-hour Work Week". And investor in companies (early stage) like Uber, Shopify, Alibaba, Facebook and Twitter.

🐨 Main Idea:

Apply Jensen's Inequality (mathematical property) to Make the Portfolio more Robust and Better — For the same amount of risk, it gives you better outcomes than any other traditional portfolio. It gives you limited-small downside and unlimited/unknown upside (definition of antifragility).

📝 Notes

Chapter 1 — Explanation of the Bipolar Strategy

How to make something ROBUST?

Focus on Jensen's inequality (mathematical property). The Bipolar Strategy is a strategy that has variations within it. It is vastly better than Mono Strategies (with no variations).

Instances:

— Health: Walk and Sprint is better than just jog.

— Investment Portfolio…

"It's much better to put 80% of your money risk-free (if you can find it), and 20% speculative. Rather than the whole thing medium risk. Much more robust that way."

- Nassim Taleb

Your portfolio is much more *robust* with a Bipolar Strategy (bipolarity on the risk level).

More examples…

Monogamous Birds follow a Bipolar Strategy! The female will take the boring-stable partner 90% of the time. And the hotshot partner 10% of the time — for a linear combination that is better than picking just a “good match”.

Chapter 2 — Tim Ferriss’s Barbell Portfolio

"I subscribe to the Nassim Taleb school of investment, with 90% in conservative asset classes like AAA bonds and the remaining 10% in speculative investments that can capitalize on positive 'black swans' "

- Tim Ferriss

Tim started his Barbell portfolio on the year 2007-2008. He invested a tiny portion (120K$) of his assets in early-stage start-ups and cryptocurrencies, diversified (initially) into 6-12 companies. His assumption for these super risky investments was that he would lose it, and it would be the sunk tuition cost for the network built, the skills developed and the knowledge acquired. He viewed it as his own MBA! The alternative was to spend that same money (120K$) in a 2-year Stanford MBA graduate program. You can find more about Tim and his Barbell portfolio on his Blogpost.

By 2018, some of his risky investments capitalized into “positive black swans”, with companies like Facebook, Twitter, Alibaba, Uber and Shopify. So his tiny risky portion grew onto becoming bit more than 50% of his total net-worth. But of course, this happened naturally! As these companies grew massively (power of compounding and being exposed to assets with big-unknown upside).

Chapter 3 — Reflections on How I think about investing

When I reflect on how to invest my money, I can think of 3 different Buckets where I can allocate the money.

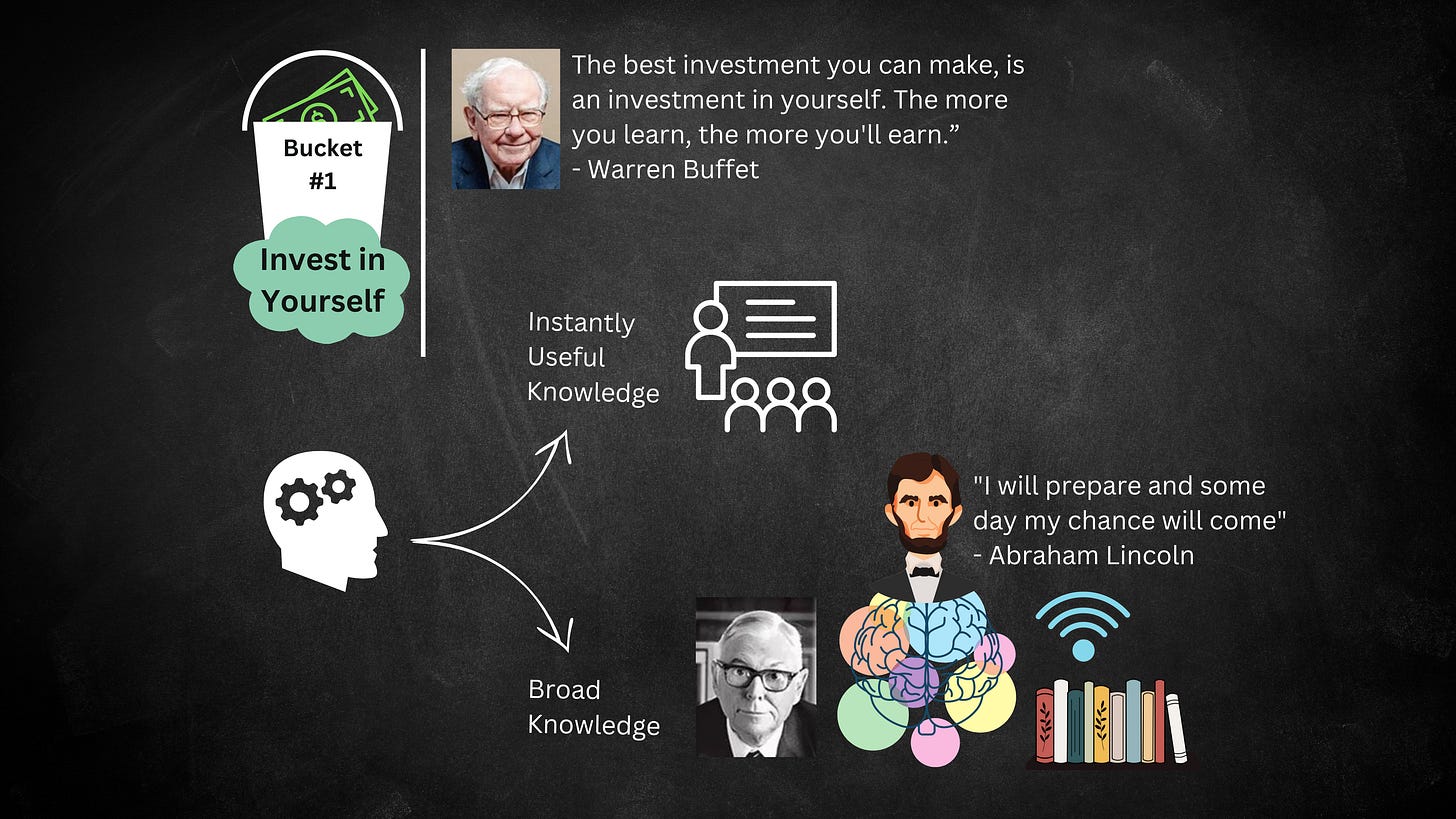

BUCKET #1 -- Invest in Yourself

"The best investment you can make, is an investment in yourself. The more you learn, the more you'll earn.”

- Warren Buffet

This Bucket is all about growing your knowledge base and skills by learning from other people's experiences and discoveries.

It can be very concrete knowledge that you already know is gonna be instantly useful to you, like for instance a workshop on how to run TikTok Ads.

But also a more broad kind of knowledge, like for example learning from the life of Charlie Munger or about mental models. And this can be very cheap because you can mostly find it on the internet for free or in books. A platform that I personally love using for this is Shortform, which is why I contacted them to create a long-term business partnership with Picking Nuggets.

I think most people just go straight to the concrete knowledge that they need, but I think it's also important to be exposed to broad big ideas because, in words of Steve Jobs, "You can't connect the dots looking forwards. You can only connect them looking backwards.". So, as you expose yourself to new ideas, you become more prepared, and as you become more prepared you will be able to see more opportunities around you.

"I will prepare and some day my chance will come".

- Abraham Lincoln

I see this Bucket as kind of like a Meta-Bucket. Because improving one’s judgement by learning from other people is a critical component for attaining success in the following 2 buckets.

Bucket #2 -- Build your own Asset

This is the entrepreneurial Bucket. Where you take your interests, creativity and knowledge to build something from scratch, which will be successful if it's useful for a group of people.

So in this Bucket you use the money to get the things that you need to start your entrepreneurial venture or make it grow. And the good thing is that nowadays is not necessary to have a lot of money or good connections to bootstrap your business, because you can freely access to infinite leverage thanks to the internet. Also, I think that tinkering in the internet is much more aligned with the barbell model that we have seen, because in the internet mistakes won't cost you any money or will be super cheap, and when you get something right you can turn it into a highly profitable business (known-small downside + unknown upside). Whereas in the case that you are purely using capital leverage, your mistakes can be very expensive. As Jimmy Donaldson (Mr. Beast) commented in the Joe Rogan Podcast... You only want to add the Capital and Labor slowly as you are proven right with your judgement.

The absolute best resource that has helped me to learn the general principles of today's Entrepreneurship is the 3-hour long Podcast Episode of Naval Ravikant on How to Get Rich.

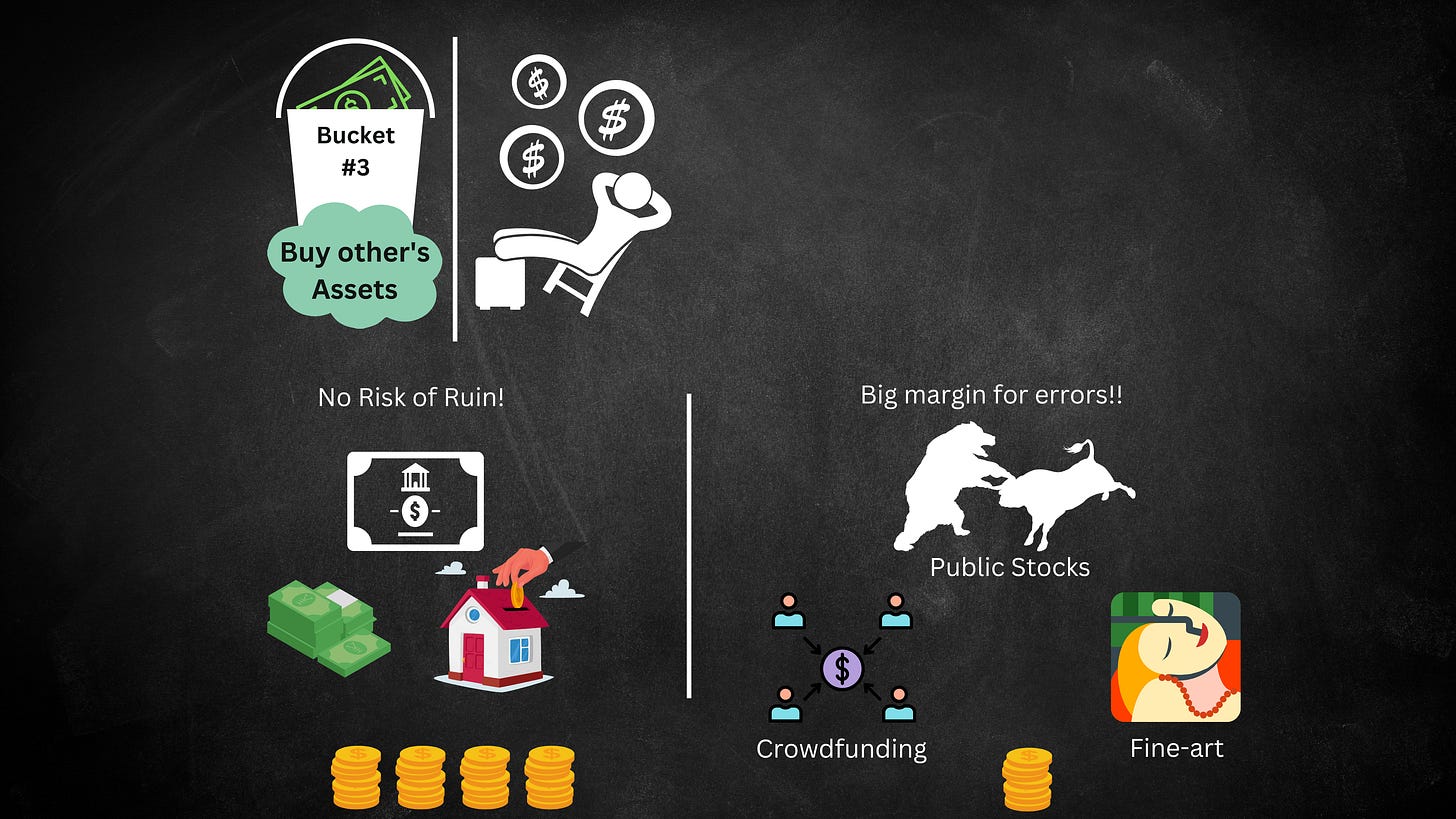

Bucket #3 -- Buy other people's Assets

This is about buying assets from other people that can potentially maintain or increase in value, and the investment is a means for passive income.

As you probably guessed, my currently favorite Asset allocation strategy for an investment portfolio would be the Barbell model. There are 2 things I love about the Barbell:

1) The obvious one, the fact that I avoid the risk of ruin. Because 80 to 90% of the money would be in low risk asset classes such as cash (also gives you optionality to take advantage in economic crisis), high-grade treasury bonds, and Real-Estate.

"Make sure that the probability of the unacceptable (i.e., the risk of ruin) is nil.”

- Ray Dalio

2) The other thing that I love, is that for the 10-20% risky portion, it's OK if I don't calculate the risks with precision because the most I can lose it's that 10-20%. My downside is limited to that tiny allocation into the risky portion. Whereas if I were to put everything into medium-risk, I would have to accurately estimate the risks. And the thing is that it is almost impossible to do this, because we all have blind-spots and we can't predict the future.

Personally, for my current circumstances and objectives… (I’m 26 yo)

I'm mostly focused on bucket 1 and 2. But I do have a barbell extreme of around 15% of my (very) little net-worth composed of highly volatile stocks, and now I'm also open to consider equity ownership through crowdfunding of private companies, or investing in the million-dollar fine-art market which has now been democratized thanks to companies like Masterworks, which btw is kindly sponsoring this newsletter.

Also, I try following Ray Dalio's advice on that the holy grail of investing is to have good diversification, as it can remove the idiosyncratic risk (the risk of a particular asset class or an instance of a particular asset class) from your investment portfolio.

But please do not take any of this as investment advise. As it is made for entertainment purposes only.

Check out the YouTube video!

Today’s Newsletter is brought to you by Masterworks!

Right now, the ultra rich are doubling their median investment into one particular market. Business Insider says demand has been “insane” for the past decade, but with 2022’s volatility, CNBC says the ultra rich may see this investment: “as a hedge against inflation, and perhaps a safer store of value than increasingly volatile stocks and crypto currencies.”What market? The art market. But more specifically, the multimillion-dollar fine art.

As an investment, its appreciation outpaced even the S&P 500 for the last 26 years, by a whopping 131%! And that’s even during the bull market of the past decade.

But if you’re not a billionaire, don’t worry; you can still diversify with art in an SEC-qualified way, thanks to Masterworks. Even as the stock market has fallen over 20% this year, Masterworks sold a painting for a 13.9% net return just a few weeks ago. That brings their last 3 sales, out of 9 total, to 13%, 17%, and 21% net returns to investors. And although past performance is not a guarantee of future results. It is pretty impressive.

Masterworks has over 600,000 users, and paintings have sold out in minutes. But you can use my special link to skip the waitlist: https://masterworks.art/pickingnuggets

See important Masterworks disclosures: http://masterworks.com/cd

👨💻Other content I have found pretty cool and valuable lately...

Stop Hustling, Start Focusing.

How to Be TRULY Original

Peter Thiel’s Tips for Changing the World

Alex Hormozi’s tweet thread: How to stay poor

Building an Idea Factory with Ali Abdaal.

Until next time,

Julio xx