Hey friend!

I collected some nuggets (from Nassim Taleb and Naval Ravikant) on why is always wiser to not follow groups in general (because of at least 3 social dynamics that occur and overrides all rational-critical thinking), and what kind of groups are the only “sane” (little clue: it has to do with real interactions, such as Businesses in Market Economies).

Hope you find it valuable :)

🧠 Top Quotes

"A group that tries to change its mind falls apart."

- Naval Ravikant

"Madness is rare in individuals—but in groups, parties, nations, and ages it is the rule."

- Nietzsche

"Science is the Belief in the Ignorance of the Experts".

- Richard Feynman

👨 People

Nassim Taleb's work concerns problems of randomness, probability, and uncertainty. Author of many successful books, including The Black Swan, which The Sunday Times considers one of the 12 most influential books since World War II.

Naval Ravikant is the co-founder of AngelList and co-author of Venture Hacks. He has invested (early-stage) in companies like Uber, Twitter and FourSquare.

📝 Notes

Chapter 1 — The Madness of Groups [Nassim Taleb]

In a speech with the GBH Forum Network, Nassim states:

"How come something can be deemed as wrong by individuals, and considered as true by the collective?"

He then mentions a saying from Fat Tony (fictional character in Nassim's books):

"Is easier to scam people with billions than scam them with thousands.

And is a lot easier to fool a multitude than to fool a single person."

As I was hearing and processing this, I couldn’t help but think of 2 particular subjects:

On the left, Sam Bankman-Fried. On the right, Bernie Madoff. They both fooled a multitude and scam them with billions of dollars. It is estimated that Madoff stole around 65 billion dollars.

Nassim argues that this statement, from Fat Tony, is fully confirmed by the following:

Social Epistemology

The study of the relevance of communities to knowledge.

Social Contagion

Involves behaviour, emotions, or conditions spreading spontaneously through a group or network.

Informational Cascades

Situation in which an individual makes a decision based on observation of others without regard to his own private information.

Nassim exposes an instance from the field of Economics…

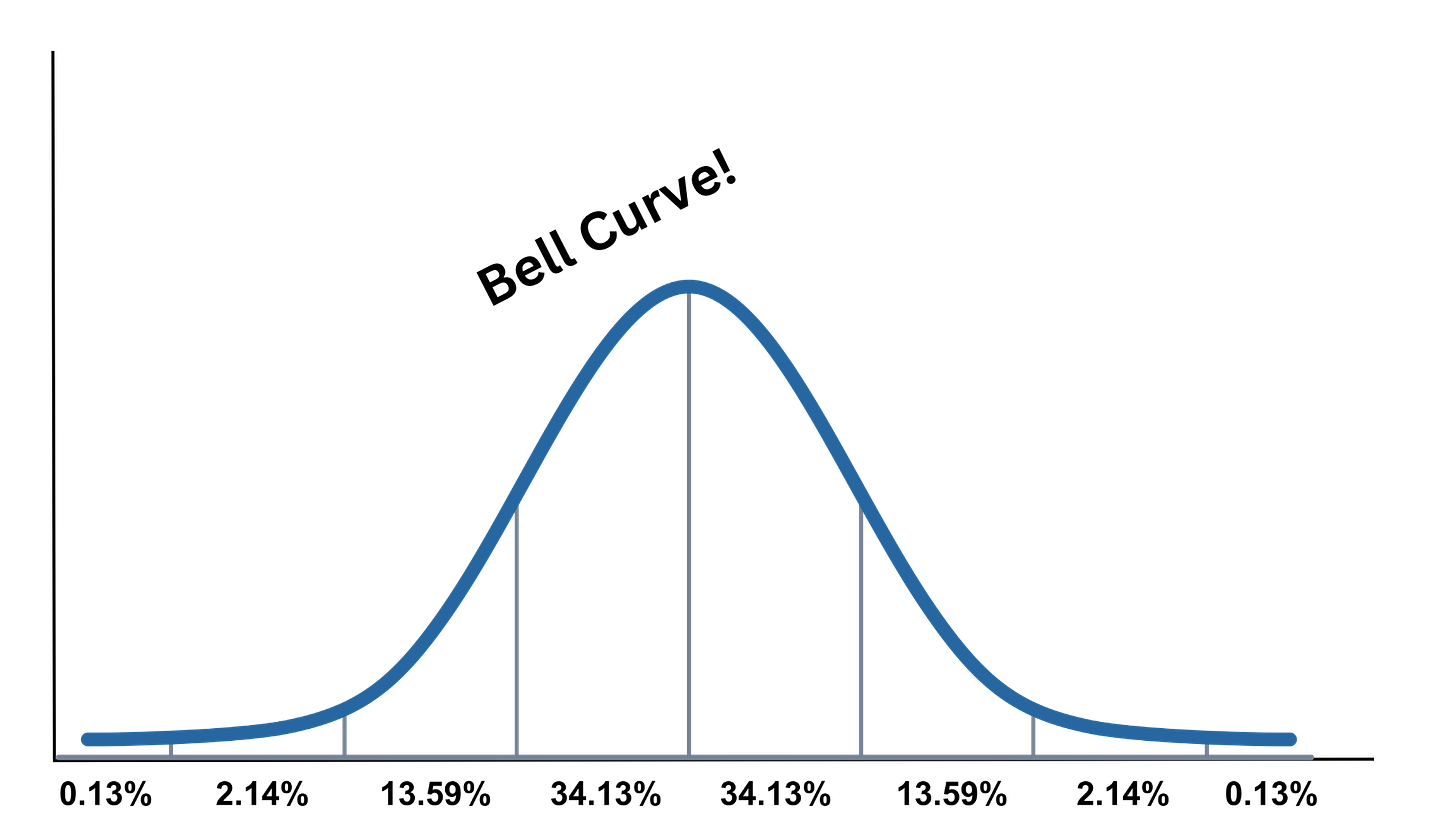

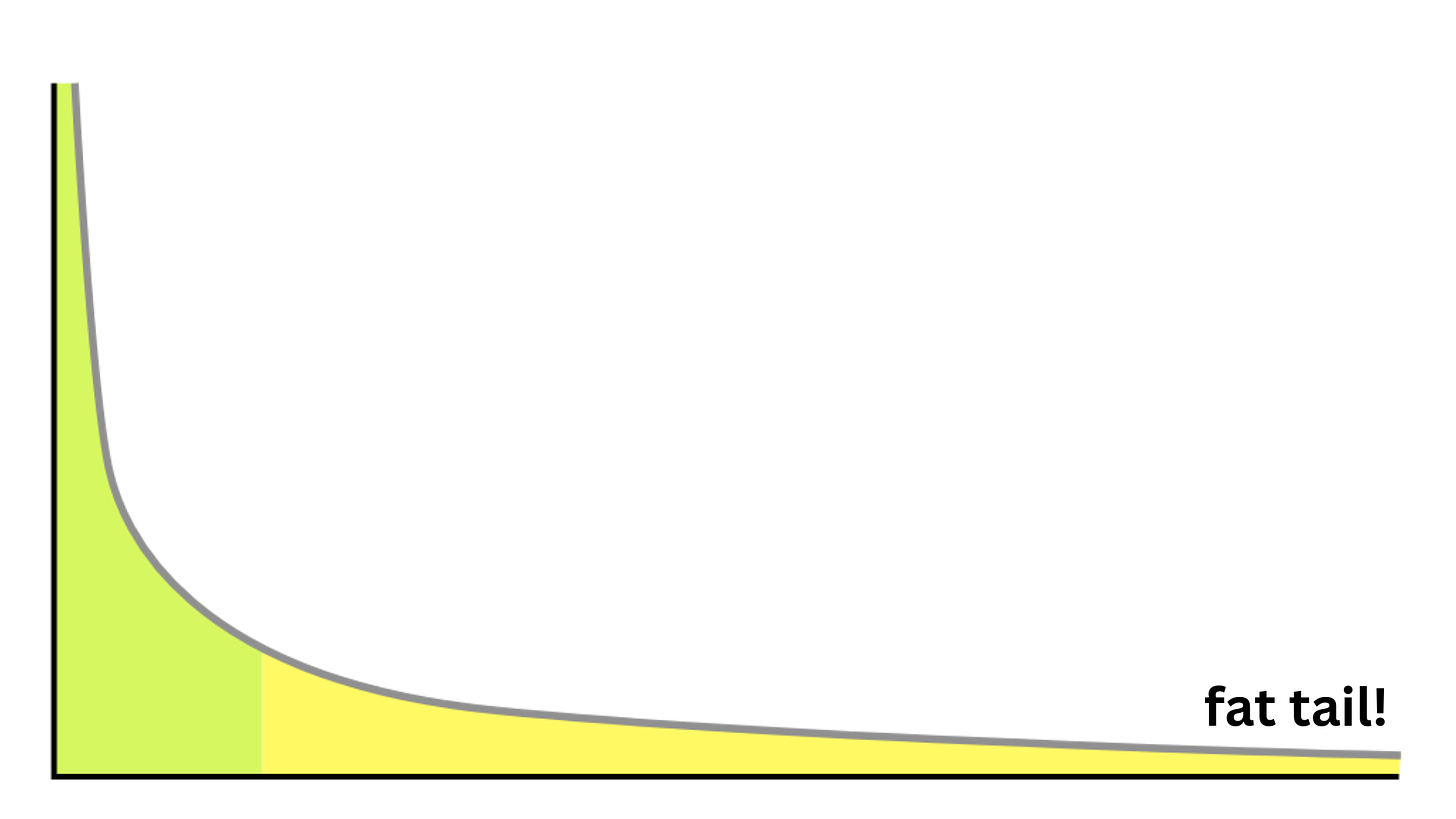

Most economists make forecasts and compute risks. But the truth is that all these forecasts and risks estimations are flat wrong, because they are based on the assumption that the Economy follows a Bell (Normal) Distribution, when in reality it follows a Power Law (what Nassim calls “Fat tail”) Distribution. And under a Power Law, computing risks and making forecasts is just not feasible — which is why Nassim claims that the key is to prepare for unforeseen risks rather than naively forecast them.

"We don’t live in a normal world; we live under a power law."

- Peter Thiel (founder of Paypal)

Passage from Peter Thiel's book "Zero to One":

"In 1906, economist Vilfredo Pareto discovered what became the “Pareto principle,” or the 80- 20 rule, when he noticed that 20% of the people owned 80% of the land in Italy—a phenomenon that he found just as natural as the fact that 20% of the peapods in his garden produced 80% of the peas. This extraordinarily stark pattern, in which asmall few radically outstrip all rivals, surrounds us everywhere in the natural andsocial world. The most destructive earthquakes are many times more powerful thanall smaller earthquakes combined. The biggest cities dwarf all mere towns puttogether. And monopoly businesses capture more value than millions of undifferentiated competitors. The power law— so named because exponential equations describe severely unequal distributions—is the law of the universe. It defines our surroundings so completely that we usually don’t even see it."After Nassim explains this truth about the world and their field to Economists, the result is no change in their way of doing things! They stick to the status quo of wrong (and harmful — since decisions are taking on wrong models) forecasting and risk computing. This is what’s called “Institutional Stickiness”. In the next chapter, Naval Ravikant offers additional good arguments for why we have this phenomenon of Institutional Stickiness.

"Madness is rare in individuals—but in groups, parties, nations, and ages it is the rule."

- Nietzsche

"It is not famine, not earthquakes, not microbes, not cancer but man himself who is man’s greatest danger to man, for the simple reason that there is no adequate protection against psychic epidemics, which are infinitely more devastating than the worst of natural catastrophes.”

- Carl Jung

"Whenever you find yourself on the side of the majority, it is time to pause and reflect."

- Mark Twain

"Be a free thinker and don't accept everything you hear as truth. Be critical and evaluate what you believe in."

- Aristotle

Chapter 2 — Groups Never Admit Failure [Naval Ravikant]

Naval argues that Groups never admit failure, because if they do they would fall apart!

"A group that tries to change its mind falls apart."

- Naval Ravikant

So the ultimate usual outcome of a Group is that it remains the same, but what happens is that a portion of the group diverges! — and sometimes that portion create a new group. Naval puts the instance of the Catholics and the subgroup that emerged from it: the Protestants.

Outcomes don’t matter

A group will declare victory regardless of the real basis of the outcome. When real outcomes don’t dictate the survivorship of the group (like with Banks, the International Monetary Fund, Non-profits, “experts” without skin in the game…), failures are dismissed by the groups. And institutional stickiness takes place — and it sticks corrosively because as Nassim argues: A system that doesn’t learn from its mistakes, is a doomed system!

Solution: Groups that have to implement feedback from reality in order to survive are the best kind of groups (the only kind that doesn’t live in delusion — because if it does, it dies). Of course, a clear example are for-profit organizations in Market Economies (except Banks — as they have what Nassim calls “a transferability of antifragility” — they take ownership of the upside thru inflated bonuses, and when bad times come is the citizens who pay for their bail-outs). Because for-profit organizations are exposed to losses. They have Skin in the Game! And so they need to admit and learn from failures if the group wants to survive.

“I believe Costco does more for civilization than the Rockefeller Foundation.

I think it's a better place. You get a bunch of very intelligent people sitting around trying to do good, I immediately get kind of suspicious and squirm in my seat.”- Charlie Munger

Picking Nuggets Note:

Among for-profit organizations, the smaller the group the better! As Paul Graham (founder of Y Combinator) argues, in a Big Corporation you can fake productivity to your boss by staying long hours in the office (though not necessarily doing anything) or making it look like you are working. But in a startup there is no BS, as the market will tell if you worked (and did a good work). What happens here is that the bigger the group, the more "averaged out" is your work input (with the work of the other employees) and so the more detached is your work with the final product and its market response. So startups are better groups because the link btw the input of its members and the market/reality response is much more direct and easy to evaluate.

"Science is the Belief in the Ignorance of the Experts".

- Richard Feynman

📁 All the ideas in this article are saved and classified in a searchable Database, which (as of July 2024) contains nearly 2,000 timeless ideas (sourced directly from the most influential doers and entrepreneurs — captured on books, interviews/podcasts and articles).

I call this Database the Doers Notebook, and I’ve recently opened it for anyone who wants it.

🤔 Why did I build this?

Well, as the Latin motto goes, “A chief part of learning is simply knowing where you can find a thing.” And since it’s all 🔎 searchable, we only need to type a keyword to immediately get a list of insights related to it!

For instance, if I’m unsure about how to get more sales in my business, I can simply type the word “sales” and immediately get 88 search results! In this case from Jim Edwards, Peter Thiel, Naval Ravikant, Paul Graham, Sam Altman, Balaji Srinivasan, Nassim Taleb, and many other remarkable individuals.

It’s like having a 🧠 second brain from which we can pull wisdom on demand.

And this is super valuable because it can significantly decrease the error rate in our judgment.

“In an age of infinite leverage [code and media], judgment is the most important skill.”

- Naval Ravikant

I actually made a video where I went through the list of insights I got for the keywords “sales” and “creative”.

So, if you wanna get better at sales and learn to be more creative (and also see all the features of the database and how you can get access) then definitely check out the video 👇

📓 Latest Thoughts

Reflecting on a quote from Alan Watts…

"To the degree that you condemn others, and find evil in others, you are to that degree unconscious of the same thing in yourself."

- Alan Watts

Reflecting on this quote, it makes me think that we underestimate the influence that a group has over its members. We are wired to do what everyone else is doing (Mimetic Theory), and even if the group engages in illogical or unethical behavior we will put a lot of effort into rationalize it somehow to never go against the group dynamic. And once we start executing on those bad/immoral behaviors, it's much more difficult to escape from the group because of 3 dynamics that stem from executing the actions:

Cognitive Dissonance

We all think of ourselves as good people. So if you do something that goes against your values or the values of the general Society, you need to convince yourself that it has to be done and justify it with whatever reasons you can find (because the dissonance of ideas is just too uncomfortable to bear). So the more bad actions you take, the more you believe in that is actually the right thing to do (humans can rationalize anything). So your marginal action will likely be increasingly more deliberate and intense on its purpose.

Consistency Bias

Tendency to make any future action consistent with actions already executed on.

The fact that everyone outside the group will condemn you and isolate you (precisely because most people is unconscious about their own potential for evil). So your only "friends" are in the group.

As you keep executing on these immoral actions, the more intense these dynamics get and the more you identify with the group and believe in the group no matter the morality of the actions that are being promoted by the group.

This is why I think that all humans are capable of the worst kind of atrocities (this is something Jordan Peterson talks a lot about. In an interview with Lex Fridman they discuss it, especially from the timestamp 3:00:00).

Is just the human condition. And we are not far from the evilness of the Nazis or the Bolsheviks or the Catholic Inquisition. This is why I believe is critical that we learn (without judging) from history and the human condition, and decrease or eliminate the consumption of sensationalistic news where mono-culturist journalists condemn people or groups (who did something wrong) with a sense of superiority and distance as if they were of a different specie.

📚 Passages I loved

Passage 1

"It seems strange to have to emphasize simplicity. You’d think simple would be the default. Ornate is more work. But something seems to come over people when they try to be creative. Beginning writers adopt a pompous tone that doesn’t sound anything like the way they speak. Designers trying to be artistic resort to swooshes and curlicues. Painters discover that they’re expressionists. It’s all evasion. Underneath the long words or the “expressive” brush strokes, there’s not much going on, and that’s frightening. When you’re forced to be simple, you’re forced to face the real problem. When you can’t deliver ornament, you have to deliver substance."

(other quotes)

"That's been one of my mantras - focus and simplicity. Simple can be harder than complex: You have to work hard to get your thinking clean to make it simple. But it's worth it in the end because once you get there, you can move mountains" - Steve Jobs

"Simplicity is the ultimate sophistication" - Leonardo Da Vinci

Passage 2

Peter Thiel on How Paypal almost died, and the Insanity of the Dotcom Bubble 👇

“We knew that the boom was going to end. Since we didn’t expect investors’ faith in our mission to survive the coming crash, we moved fast to raise funds while we could. On February 16, 2000, the Wall Street Journal ran a story lauding our viral growth and suggesting that PayPal was worth $500 million. When we raised $100 million the next month, our lead investor took the Journal’s back-of-the-envelope valuation as authoritative. (Other investors were in even more of a hurry. A South Korean firm wired us $5 million without first negotiating a deal or signing any documents. When I tried to return the money, they wouldn’t tell me where to send it.) That March 2000 financing round bought us the time we needed to make PayPal a success. Just as we closed the deal, the bubble popped.”

“Madness is rare in individuals—but in groups, parties, nations, and ages it is the rule.” - Nietzsche

👨💻Other content I have found super valuable lately…

- Lex Fridman Podcast with Sean Kelly. 3 insights I took:

There might not be a "global meaning", but you can find "local meanings" everywhere — anything that brings you a moment of deep joy. When “there is no place I rather be, there is no thing I rather be doing, there is nobody I rather be with, and this I will remember well”.

You can't appreciate the joy of life without also experiencing the grief and darkness.

Relationships and taking responsibility for other people is very meaningful for humans.

- Quick explanation of “Fat Tails” (the Power Law Distribution) by Nassim Taleb

- The Laws of Marketing by Mohnish Pabrai

- A Marketing tip from Alex Hormozi

Until next time :)

Julio xx

P.S. If you liked this article, you'll definitely enjoy my free 80-page ebook. It’s packed with 23 big ideas (from top influential doers and entrepreneurs) to become better, richer and wiser. Download your copy here!